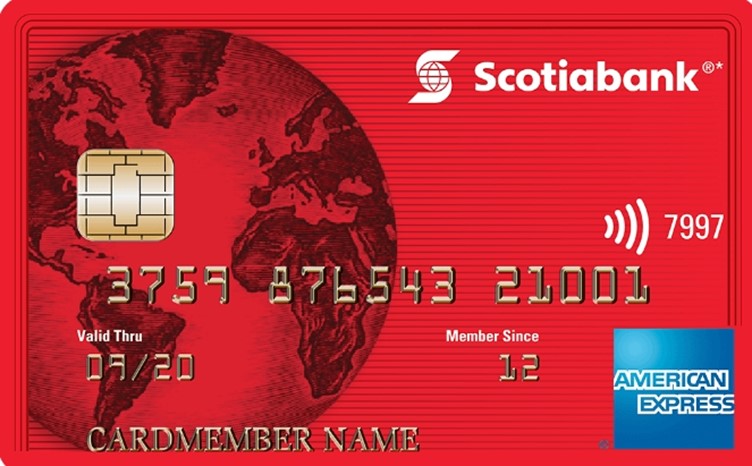

MEANING OF CREDIT CARD

A credit card is usually a plastic card that a financial institution issues to its customers so that the latter can have access to credit facilities. The Western Union established the first credit card company in the 1920s. Modern credit cards can be used for making purchases at most retailers, for shopping via the internet, and for making cash withdrawals from ATMs. An individual can derive a plethora of benefits from using a credit card. A credit card is also not free from drawbacks. Let us have a look at the pros and cons of credit cards.

ADVANTAGES OF CREDIT CARDS

1) Credit cards are convenient to use for transactions involving a large amount of money.

2) They are light in weight so hence they can be carried with comfort while traveling.

3) The customers usually love places where they can avail credit facilities. This indicates that they would show loyalty to the financial institutions.

4) One cannot use someone else’s credit card without the permission of the holder. Therefore the former cannot steal the money of the latter.

5) One is not required to waste time going to the bank or the ATM for withdrawing money to make a payment.

6) There are many credit card issuing institutions that offer discounts for attracting people to use their credit cards. The discount is dependent on the amount of purchase.

7) Credit card statements can aid the holder in tracking his/her expenses. Some credit card providers make year-end summaries available to their customers which are of great help for tax assessment purposes.

DISADVANTAGES OF CREDIT CARDS

1) Sometimes the credit cards of many users are hacked and large amounts of money may be added to their accounts.

2) Credit card issuers charge some interest on the credit cards. This indicates that a credit cardholder will have to pay more than the amount used by him/her.

3) One cannot see the money is depleted. Therefore it is highly probable that there are chances that a credit card user will misuse his/her money thinking that he/she still has more.

4) Credit cards can only be used in selected areas. This means that credit cards are not accepted by all vendors so a user is going to face such inconvenience.

5) Credit cards are usually given to people enjoying a high standard of living in society. They are not meant for the poor people and illiterates living in the society.

6) When one loses his/her credit card, he/she will have to pay some amount of money to get a replacement of the same.

7) A credit card user needs to keep his/her receipts and check them against his/her statement every month. In this way, one can make sure that he/she has not been overcharged by the credit card issuer.

CONCLUSION

Credit cards are very good to use but one should be careful while using them same. One should keep it safe and make sure that nobody knows the PIN number of the credit card. Letting others know the PIN details of a credit card is inviting someone to steal one’s money. A credit card can either help a person or hurt him/her depending on how he/she uses the same.